COMPASS MINERALS INTERNATIONAL (CMP)·Q1 2026 Earnings Summary

Compass Minerals Crushes Q1 as Winter Weather Drives 103% EBITDA Surge

February 5, 2026 · by Fintool AI Agent

Compass Minerals delivered a blowout fiscal Q1 2026, crushing estimates across all metrics as robust winter weather drove a 37% surge in Salt segment volumes. The company swung to profitability with net income of $18.6 million versus a $23.6 million loss in the prior year, while adjusted EBITDA more than doubled to $65.3 million.

Management raised full-year EBITDA guidance by 2% at the midpoint and announced the strategic sale of its Wynyard sulfate of potash facility for $30.8 million, furthering its debt reduction goals.

Did Compass Minerals Beat Earnings?

Compass Minerals beat on every key metric:

Consensus estimates from S&P Global

The revenue beat was driven entirely by volume strength in the Salt segment, where highway deicing sales volumes surged 43% year-over-year to 2.85 million tons on favorable winter weather conditions.

Year-over-year comparisons were equally impressive:

What Drove the Segment Performance?

Salt Segment: Winter Weather Delivers

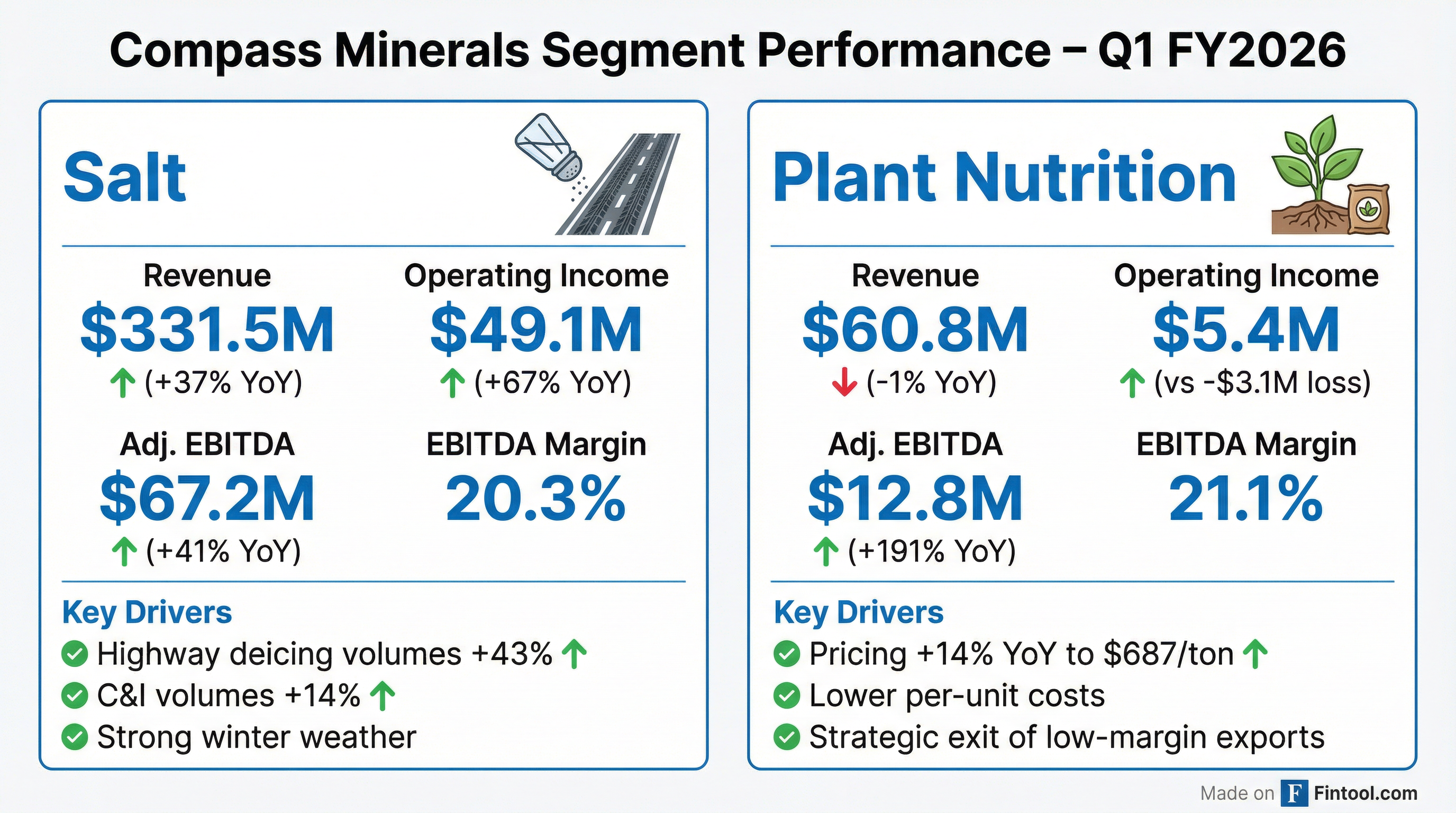

The Salt business was the star performer, with revenue up 37% to $331.5 million.

Key Salt metrics:

Volume strength across both highway deicing (+43%) and consumer & industrial (+14%) channels drove the outperformance. Pricing remained positive with highway deicing up 6% and C&I up 2% year-over-year, though the sales mix shift toward lower-priced highway deicing kept overall segment pricing roughly flat.

Plant Nutrition: Margin Expansion Story

Plant Nutrition revenue dipped 1% to $60.8 million on 13% lower volumes, but the profitability story was compelling. The segment swung from an operating loss of $3.1 million to operating income of $5.4 million.

Key Plant Nutrition metrics:

Management noted the lower volumes reflect a strategic decision to exit lower-margin export opportunities, focusing on higher-value domestic sales.

What Did Management Guide?

Compass Minerals raised its full-year FY2026 adjusted EBITDA guidance by 2% at the midpoint, now expecting $208-240 million versus prior guidance of approximately $204-235 million.

Updated FY2026 Guidance:

The guidance includes the impact of the Wynyard SOP operation sale but excludes any proceeds from that transaction. Capital expenditures remain unchanged at $90-110 million.

What Changed From Last Quarter?

Several key developments marked a shift in Compass Minerals' trajectory:

-

Return to profitability: Net income of $18.6M marks the first profitable quarter after four consecutive quarterly losses totaling over $120 million.

-

Deleveraging progress: Net debt decreased $92 million (10%) year-over-year to $836.9 million. The net debt to trailing 12-month EBITDA ratio improved dramatically to 3.6x from 5.3x.

-

Strategic divestiture: Subsequent to quarter-end, Compass Minerals agreed to sell its Wynyard, Saskatchewan SOP operation for $30.8 million. Management noted this asset was "surplus to needs" given its ability to service customers from its core Ogden, Utah facility. Proceeds will further reduce net debt.

-

Liquidity position: The company ended the quarter with $341.7 million of liquidity, comprising $46.7 million cash and $295 million availability under its revolver.

How Did the Stock React?

CMP shares closed the regular session at $25.52, down 3.99% on the day. However, after-hours trading following the earnings release saw the stock surge to $26.93, up approximately 5.5% from the close.

Stock Performance Context:

The stock has rallied dramatically from its 52-week low of $8.60, reflecting improving fundamentals and successful execution of management's turnaround strategy.

Why Didn't Compass Capitalize More on the Strong Winter?

A key question from the earnings call: if winter conditions were so favorable, why wasn't the guidance increase larger? Management provided critical context:

Goderich Mine is in a development-heavy phase — new mining panels require infrastructure build-out that constrains near-term production capacity. CEO Dowling emphasized: "As long as we're in the development sequence, which you measure in quarters... the costs are always gonna be a little bit higher."

Strategic inventory discipline — Management explicitly chose not to over-produce after prior years of excess inventory stressed the balance sheet. "We made the right decision to align the business more closely with anticipated market demand... Our inventory management plan could preclude our ability to meet excessive demand in fiscal 2026."

Unplanned downtime headwinds — Production at Goderich faced "greater than anticipated unplanned downtime" that management is addressing through improved preventive maintenance programs.

The positive takeaway: industry-wide deicing inventories are now low, which is "very constructive as we look forward and start planning for 2026, 2027 winter."

What Should Investors Watch Next?

Key catalysts ahead:

-

Goderich development timeline — Management promised updates "over the next quarters" on the new mill project, which is currently in value engineering. Progress on the 3B108 project and East Mine Drive will determine when production capacity expands.

-

Wynyard sale closing — The $30.8 million divestiture is subject to customary closing conditions. Proceeds will reduce net debt further.

-

Q2 salt volumes — The second fiscal quarter (Jan-Mar) is typically the peak winter weather period. Market tightness and low industry inventories could support pricing if winter continues strong.

-

Capital allocation discussions — Management will begin board conversations on capital allocation as leverage improves, potentially signaling dividend reinstatement or other shareholder returns.

-

Ogden dryer compaction project — The next phase of Plant Nutrition improvement involves capital upgrades at Ogden expected to boost both efficiency and financial performance.

Q&A Highlights

The analyst Q&A revealed important context on operational constraints and market dynamics:

Is the Salt Market Well-Supplied?

BMO's Evan McCall asked whether the market could handle the strong winter or if imports were needed. Chief Commercial Officer Ben Nichols noted:

"The market has become tight. Winter has certainly trended ahead in terms of a straight calendarization, so that's something the market hasn't seen in quite a few seasons. The ability for imports and opportunistic supply to play a role mid-season is difficult, just given the lead time of supply in transit... If the winter continues as it has, the market will remain tight."

Why Didn't Guidance Go Higher in a Strong Winter?

CEO Edward Dowling emphasized this is not "a new normal for this kind of winter" — a key nuance for investors expecting bigger upside in severe winters:

"Goderich Mine is in a period of high development. The mine is currently developing a number of new mining panels, which require the construction of new underground infrastructure and ground support. New development panels inherently have higher costs and lower production rates than panels that are in full production."

"The production ramp-up at Goderich Mine in mid-fiscal 2025 [came] later than anticipated, due to uncertainties around the applicability of the USMCA and subsequent hiring and qualifying of miners."

What's Driving Higher Distribution Costs?

Freedom Capital's David Silver asked about logistics cost headwinds despite higher volumes. Management explained:

"Because Q1 of this year was so robust compared to prior year, we're shipping salt across a much wider network to service the business. Essentially, we're pushing salt and shipping it to further away destinations to meet the demand, which results in a little higher rates."

New Mill at Goderich Progress

On the critical capital project timeline, CEO Dowling outlined three related initiatives:

"There's really three projects associated with the new mill at Goderich Mine. First, the East Mine Drive, where we connect the current mining areas directly to the east to tie into existing infrastructure. Second is the 3B108 project, connecting the shafts and infrastructure to the East Mine Drive — that project is really just getting underway. In terms of the new mill itself, it's in engineering... We're currently in the value engineering stage, and we should have things that we can talk about here over the next quarters."

Key Quotes From Management

CEO Edward C. Dowling Jr. highlighted the strategic progress and balance sheet improvement:

"For the first time since 2023, we're reporting positive quarterly net income... Adjusted EBITDA doubled to $65 million. We took leverage down year on year by nearly two turns to 3.6 times."

"Short-term market for the entire salt industry is really tight. Compass Minerals continues to focus on efficient and safe delivery of every ton of salt possible, understanding the critical role that we and others in the industry play in the communities we serve."

On capital allocation priorities, Dowling signaled potential changes ahead:

"The balance sheet and financial health of the company continue to improve... We've grown confidence in continuing to improve our leverage profile. We plan to begin conversations with the board about approaches around capital allocation."

On Plant Nutrition improvements:

"As the pond complex continues to improve, the quality of the feedstock that goes into Ogden also improves, provides benefits on how the plant operates, drives costs down. We've continued to make progress on this initiative, and we've seen product costs trend down."

View the full Q1 2026 Transcript | CMP Research Page | Prior Quarter Earnings